As we make our way into the New Year, and with Lunar New Year celebrations wrapping up, our team at Financial Literacy Counsel would like to highlight some of the market activities that have been in the media. We address the expected recession, how fixed-income is making a comeback, the relationship between interest rates and inflation, and why diversification continues to be key.

Macro Update: Seasonal Recession

In the US, a recession continues to loom, with Vanguard reinforcing this sentiment by noting companies are reducing earnings expectations (2022, p.48). However, Russell predicts that it will be mild and that the decline in GDP and increase in unemployment GDP, which are typical symptoms of a recession, will be less than the average changes associated with this business cycle phase (2023, p.5).

As for Canada, they also expect a light recession. In recent years a hot market with high housing prices contributed to the economy’s expansion and household spending. Higher rates and a slower housing market will mean a decrease in activity. Additionally, slowing global growth will decrease demand for Canadian exports (Russell, 2023, p.8).

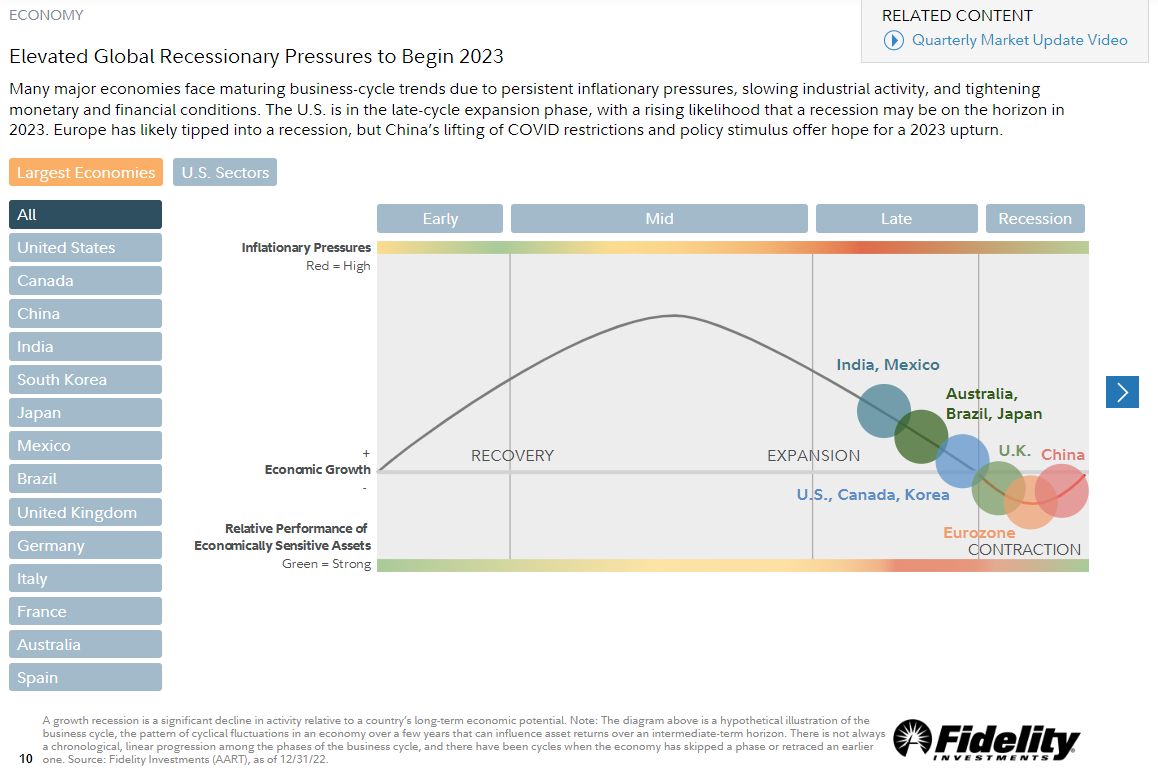

Our last update highlighted that this is all part of the business cycle. The benefit of this phase is that an increase in unemployment will help curb inflation (Russell, 2023, p.5). To illustrate this, think about the seasonal flu, which often comes around during the winter months in British Columbia. It can be difficult to avoid, but if you are generally healthy, you can get away with a milder version. Though uncomfortable, it does not prevent you from leaving your bed. After rest and treatment, you can go back to feeling fresh!

(Fidelity, 2023, s.10)

Asset Update: TARA Makes a Comeback

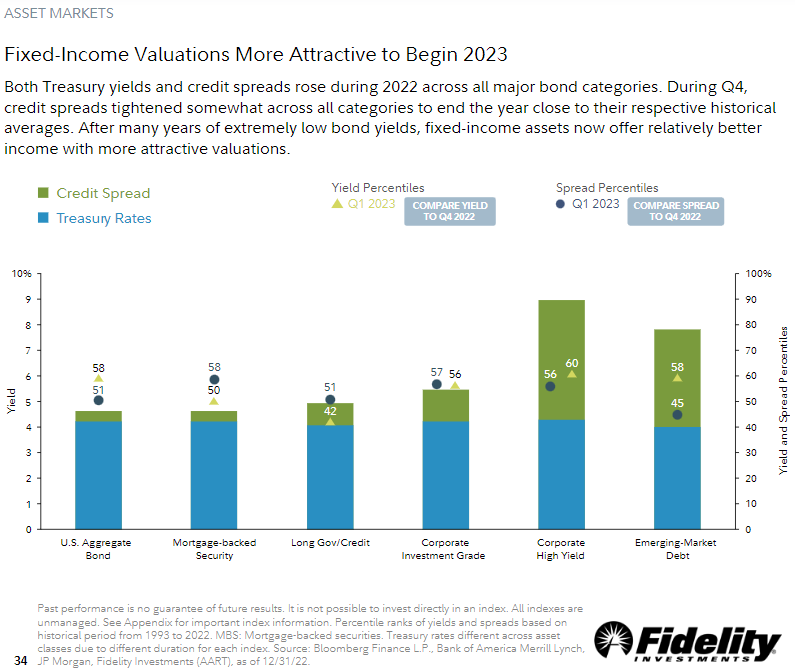

In the years leading up to 2022, fixed income offered limited potential returns due to the lower interest rates. Many investors seeking moderate returns increased their equities investments because they believed in TINA: there is no alternative. In 2022, we saw a rapid increase in interest rates, which led to the worst performance in the bond market in recent history (Fidelity, 2023, s.5).

The upside is that the current fixed-income prices now offer room for upside, with Vanguard estimating 4.1-5.1% returns on US Bonds (2022, p.5). This allows for TARA’s return: there are reasonable alternatives. Investors can consider increasing the bond allocation in their portfolio to help achieve their desired returns, but with reduced volatility.

(Fidelity, 2023, s.34)

Hot Topic: Rising Interest in Reducing Inflation

Canadians may be feeling the pinch of monetary policy as some have watched their monthly mortgage payments increase significantly. With both higher cost of living and higher interest rates, consumers have less to spend. As a result, Russell sees that inflation has peaked (2023, p.16), meaning the changes are working. When the central bank is happy with inflation levels, they may stop raising interest rates.

Though the US rates may lower slightly by the end of the year, Vanguard notes that they will likely remain elevated until inflation concerns have passed (2022, p.22). We expect Canada will have a similar experience. This precaution can be compared to an antibiotic prescription. If your symptoms appear to have cleared up before you have completed your course of treatment, physicians still recommend that you continue until it is done. It is better to ensure the issue has fully been resolved than risk creating one that is resistant to treatment.

(Fidelity, 2023, s.20)

Summary: Diversification and Discipline

Last quarter, we shared a chart showing that historically, having a balanced portfolio has outperformed cash for lengths of time ranging from 3 years to 10 years, regardless of the inflation level when starting. Further, the current interest rate environment makes a strong case for holding fixed income. Investors who have been holding onto their cash and would like to slowly start getting invested again can transition into this.

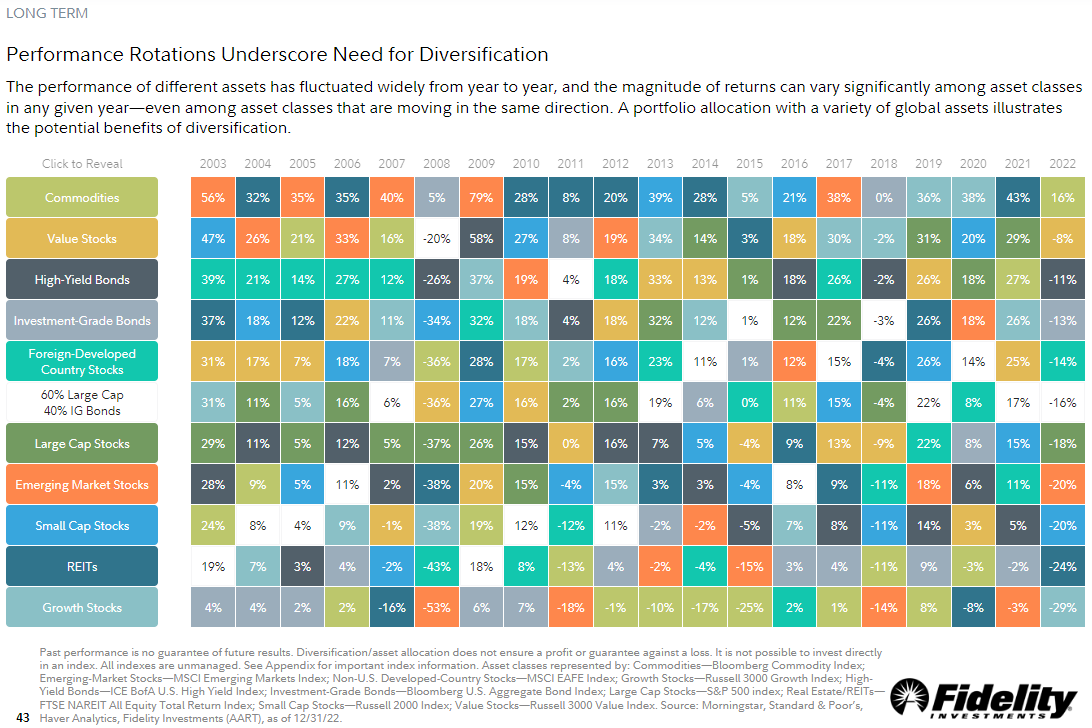

Inflation and interest aside, staying diversified is good practice. The chart from Fidelity below demonstrates how different categories of investments have performed each year, with the “winners” and “losers” always rotating (2023, s.43). Since we are not able to perfectly predict how the year will unfold, spreading your wealth across different areas will help you participate in some of the winners, while limiting the losses associated with the losers.

(Fidelity, 2023, s.43)

At FLC, we are firm believers in having a long-term plan and maintaining a disciplined approach to investing. By getting to know you and assessing your situation, our advisors can create a financial prescription for your individual needs. The result should be a smoother experience through all phases of the markets.

Have any questions? Please feel free to reach out to your advisor!

The comments contained herein are a general discussion of certain issues intended as general information only and should not be relied upon as tax or legal advice. Please obtain independent professional advice, in the context of your particular circumstances. This article was written, designed and produced by Financial Literacy Counsel, a registered trade name with Investia Financial Services Inc., and does not necessarily reflect the opinion of Investia Financial Services Inc. The information contained in this article comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any securities.

Mutual Funds are offered through Investia Financial Services Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

Sources:

Vanguard Research. (Dec. 2022). Vanguard economic and market outlook for 2023: Beating back inflation. https://corporate.vanguard.com/content/dam/corp/research/pdf/isg_vemo_2023.pdf

Fidelity Investments. (Jan. 2023). Quarterly Market Update: First Quarter 2023. https://institutional.fidelity.com/app/popup/item/RD_13569_30073.html

Russell Investments. (Jan. 2023). 2023 Global Market Outlook: From darkness to dawn. https://russellinvestments.com/-/media/files/ca/en/insights/global-market-outlook/2023-q1-gmo-full-report.pdf