(Photo by Spencer Watson on Unsplash)

Going for an outdoor adventure, like a hike, may sound simple at first glance, but for those experienced enough understand that that may not always be the case. Similarly, navigating financial markets comes with its own challenges that can be surprising to those who are underprepared. This quarter, we discuss a delayed recession, Canada’s inflation target, and how investments have performed this year.

Macro Update: Are we there yet?

This summer, Vancouverites have flocked to the dirt trails of local mountains. Now imagine, exhausted a climb, you look up and expect the next sign to show that you are 200m to your destination, only to find that you still have a kilometre left. This is how we feel about the bank pushing their target expectations to 2025, but we know that if we keep moving, we will get there.

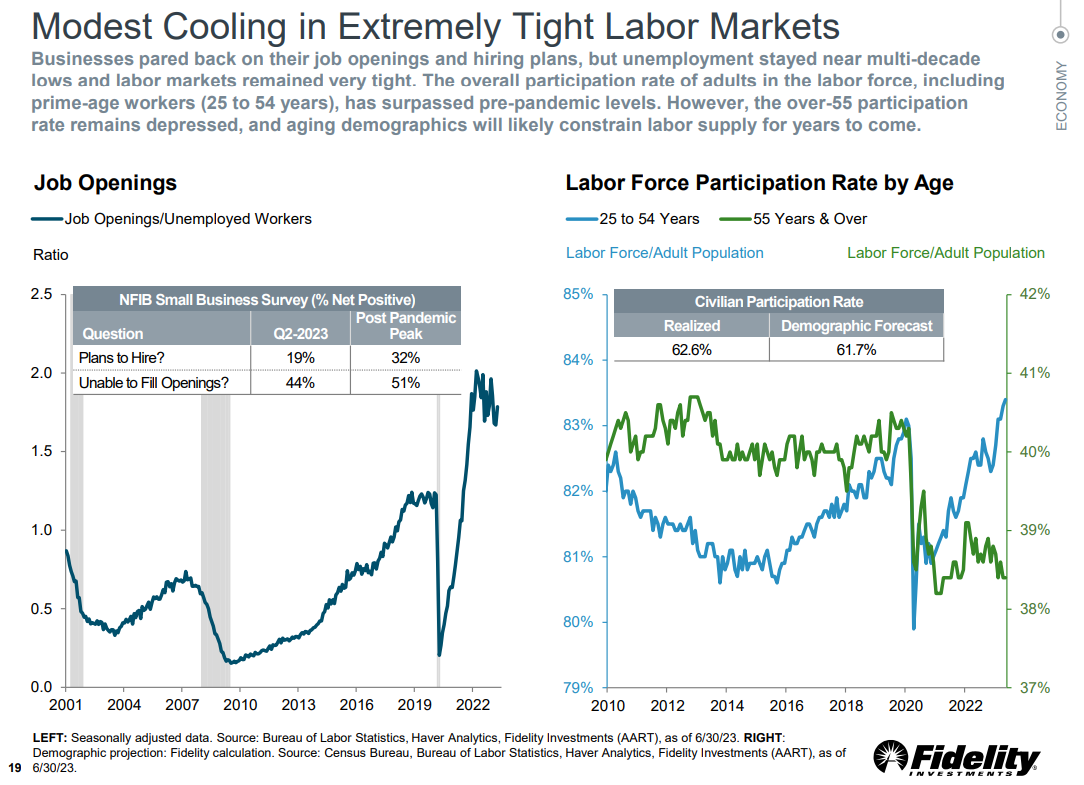

Both Canada and the United States remain in the late phase of the business cycle, with forecasts of a recession by Russell Investments pushed to 2024¹. According to the chart from Fidelity Investments, there has been a decline in small businesses’ plans to hire, which suggests an expectation of slowing economic activities². This reduction in job opportunities, relative to the number of available workers, can help control wage inflation and overall inflation.

Speaking of inflation, the Bank of Canada reported that the inflation rate for June 2023 stood at 2.8%, falling within its target range of 1-3%, but picked up to 3.3% in July³. Despite the uptick, this figure indicates a positive development compared to the 5.9% in January and 8.1% in June 2022. However, this progress has come with adjustments, and the Bank of Canada has raised interest rates twice in the past quarter, bringing the current interest rate to 5%. Still, they expect it will take until 2025 to reach their 2% target⁴.

²

Hot Topic: Gentle inclines preferred

If you were preparing for a full day hike, would you rather plan to carry extra food and water to ensure that you and your family have enough to tackle a steep climb, or just enough to get you all through a gentle stroll? A gentle incline over the same distance will require significantly fewer supplies.

The Bank of Canada has conveyed its commitment to further rate increases if necessary to achieve its 2% inflation target⁵. Maintaining this target is crucial for helping Canadians effectively plan their financial future and serves as a more stable baseline for handling unexpected economic fluctuations. Being able to anticipate future expenses is essential for retirement and savings planning in your overall financial strategy.

In its July 12th Monetary Policy Report, the Bank of Canada highlighted that increased immigration could play a role in curbing wage inflation, but it could also contribute to consumer inflation due to the higher population’s increased consumption needs⁴.

Asset Update: Different paths, same destination

Now, you reach a fork in the trail, with two paths that lead to the same vista:

- Varying terrain that climbs steeply up some parts, then back down on others

- A gravel path that averages out the incline over the distance for a smooth climb

For some, the varying terrain may be fun, especially if they do not mind the extra sweat. For others, the gravel path is preferred.

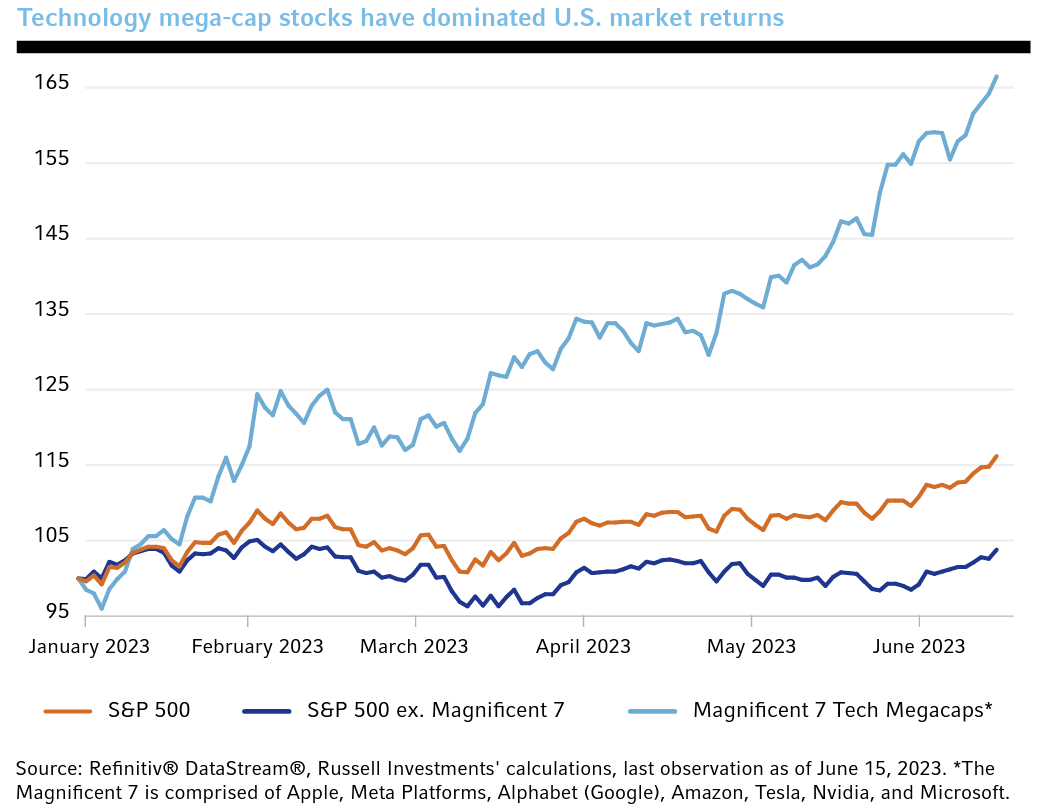

As of August 1st, 2023, the S&P 500 has shown a notable return of 19.2% for the year. However, it’s important to understand that most of this growth can be attributed to a select few major technology companies and the public’s excitement about artificial intelligence. When we look closer at the data presented by Russell Investments, excluding these top-performing companies, the actual return of the index as of June 15th was only 3.8%¹. This lower figure indicates a potentially challenging economic environment in the US that could lead to a recession.

In our recent updates, we’ve highlighted fixed income as an appealing choice for investors seeking moderate returns with lower risk, and this trend continues. Vanguard, as of July 19th, has provided a 10-year outlook with expected annualized returns for various equity and fixed income categories and can be found here⁶. Interestingly, they predict that certain bond categories could offer comparable returns to US equities but with significantly lower risk, as indicated by their projected volatility. It’s essential to keep in mind that these predictions are based on current market conditions and may evolve over time.

¹

¹

Summary: Choose your own adventure

With hiking, if you simply keep going, you will eventually reach your destination. Your choices, such as the level of difficulty or the amount of preparation, are part of what affect your journey. Saving and investing is also dependent on the risk level you choose and how knowledgeable you are about your situation, so you can choose the best path for you to reach your goals. Of course, both are also impacted by uncontrollable factors, such as weather in hiking and pandemics affecting the economy. Being prepared and understanding the impacts of our decisions puts us in a better position, no matter what the situation.

Reach out to your advisor if you have any questions about your financial plan and how your investments are positioned to handle your journey.

(Photo by Reuben Obery on Unsplash)

The comments contained herein are a general discussion of certain issues intended as general information only and should not be relied upon as tax or legal advice. Please obtain independent professional advice, in the context of your particular circumstances. This article was written, designed and produced by Financial Literacy Counsel, a registered trade name with Investia Financial Services Inc., and does not necessarily reflect the opinion of Investia Financial Services Inc. The information contained in this article comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any securities.

Mutual Funds and ETFs are offered through Investia Financial Services Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

Sources:

[1] Russell Investments. (Jul. 2023). 2023 Q3 Global Market Outlook: SLOWLY SLOWING. https://russellinvestments.com/-/media/files/ca/en/insights/global-market-outlook/2023-q2-gmo-full-report.pdf

[2] Fidelity Investments. (Jul. 2023). Quarterly Market Update: Third Quarter 2023. https://institutional.fidelity.com/app/literature/item/9871152.html

[3] Bank of Canada. (accessed on Aug. 18, 2023). Key inflation indicators and the target range. https://www.bankofcanada.ca/rates/indicators/key-variables/key-inflation-indicators-and-the-target-range/

[4] Bank of Canada Media Relations. (Jul. 12, 2023). Monetary Policy Report – July 2023. https://www.bankofcanada.ca/2023/07/mpr-2023-07-12/

[5] Macklem, Tiff -Bank of Canada. (May 4, 2023). Getting inflation back to 2%. https://www.bankofcanada.ca/2023/05/getting-inflation-back-to-2/

[6] Vanguard Investment Strategy Group. (Jul. 27, 2023). Market perspectives. https://advisors.vanguard.com/insights/article/series/market-perspectives#projected-returns