Interest rates remain elevated, inflation stabilized, and fixed income continues its appeal. This article draws parallels between the coming of winter and the economic climate, offering investment insights for an uncertain future.

Macro Update: Feels Like Fall

Forecasting the economy resembles predicting the weather; both have brought their share of surprises in the last few years. The expectation is that, like the winter cold, a recession is expected at some point. Yet, the questions are not “if” but rather “when” and “how severe.”

The Bank of Canada (BoC) has maintained a steady interest rate of 5% in response to various economic signals. Lower consumption, reduced demand for housing and goods, and decreased business investments have contributed to this decision. The labour market has also slowed down, with recent immigration partly impacting this trend¹. As a result, inflation appears to be stabilizing, with the September inflation rate standing at 3.8%².

Canada is showing more evident signs of economic slowdown and Russell Investments noted that we may have a higher risk of recession compared to the United States. However, analysts remain cautiously optimistic, suggesting that if a recession occurs, it is more likely to be mild to moderate³.

Asset Update: The Art of Layering

Vancouver’s fall can be unpredictable, with sunny days followed by chilly ones. Layering is the key to navigating this season. While a sweater might be cozy in one moment, an extra layer is your best friend for staying comfortable in changing weather, so why not have both?

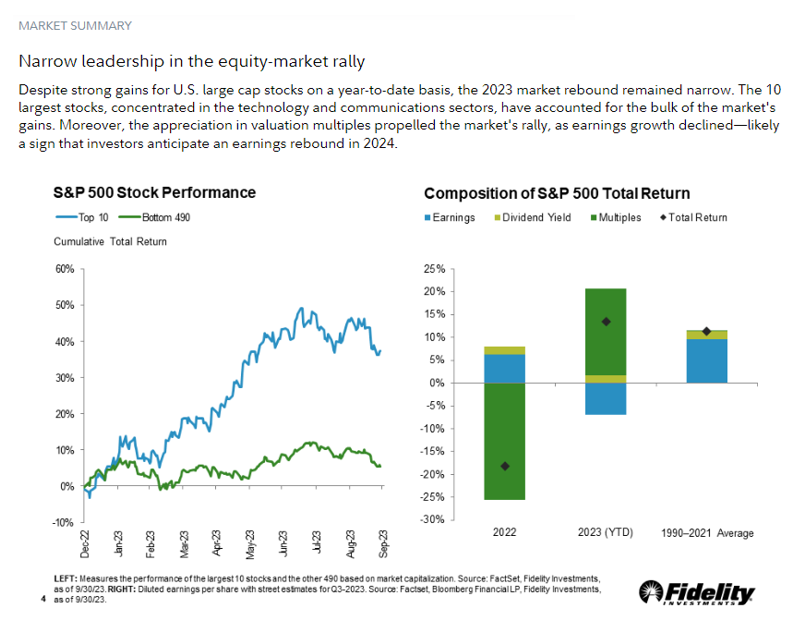

Though both Canadian and U.S. equities were down this past quarter, there’s been a notable divergence in performance between Canadian and U.S. equities. As of October 25th, the year-to-date performance revealed the TSX down by 2.25%, while the S&P 500 holds an increase of 9.04%⁴⁵. Russell Investments notes that the positive performance of the U.S. market continues to be buoyed by key players like Nvidia³. A chart from Fidelity underscores this point below⁶. Russell also cautions that Canadian equities exhibit a cyclical nature and are more susceptible to events triggered by a recession³.

Vanguard’s forecasts for U.S. 10-year returns are within a range of 2% for equities and tighter 1% for fixed income. For instance, U.S. equities are projected to return between 3.7% to 5.7%, while U.S. aggregate bonds are expected to land between 4.0% to 5.0%, offering a more stable investment option with lower risk⁷. This reinforces our earlier suggestion that fixed income may be an attractive choice for those seeking reasonable returns with reduced volatility.

Summary: Anticipating Spring

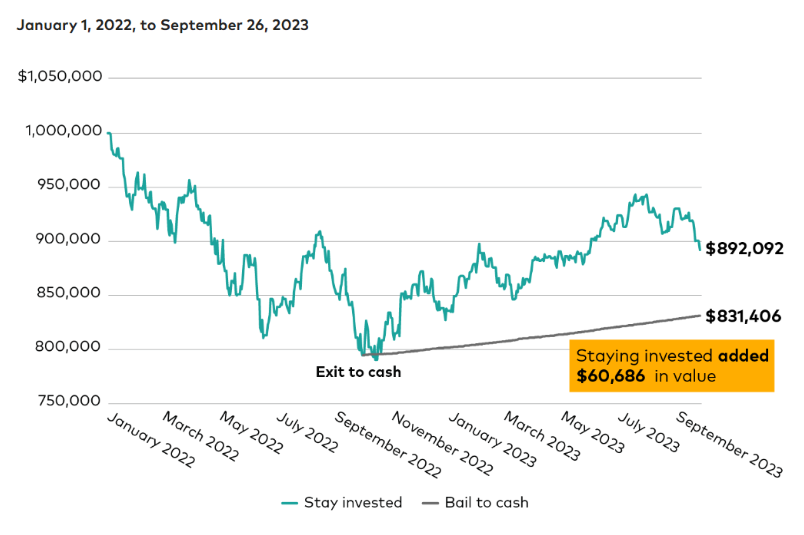

Uncertainty mirrors the unpredictability in both the financial world and the natural world, but much of it is seasonal. This is why Vanguard emphasizes that investors “stay the course”. Their chart illustrates how staying invested after a market low can be more beneficial than moving to cash⁸. If you have questions regarding your investments aligning with your long-term plan, it’s advisable to consult your financial advisor.

Sources:

[1] Bank of Canada Media Relations. (Oct. 25, 2023). Bank of Canada maintains policy rate, continues quantitative tightening. https://www.bankofcanada.ca/2023/10/fad-press-release-2023-10-25/

[2] Bank of Canada. (accessed on Oct. 25, 2023). Key inflation indicators and the target range. https://www.bankofcanada.ca/rates/indicators/key-variables/key-inflation-indicators-and-the-target-range/

[3] Russell Investments. (Oct. 2023). 2023 Q4 Global Market Outlook: FALLING IN STYLE. https://russellinvestments.com/-/media/files/ca/en/insights/global-market-outlook/2023-q4-gmo-full-report.pdf

[4] https://www.spglobal.com/spdji/en/indices/equity/sp-tsx-composite-index/#overview

[5] https://www.spglobal.com/spdji/en/indices/equity/sp-500/#overview

[6] Fidelity Investments. (Oct. 2023). Quarterly Market Update: Fourth Quarter 2023. https://institutional.fidelity.com/app/popup/item/RD_13569_30073.html#slide3

[7] https://advisors.vanguard.com/insights/article/series/market-perspectives#projected-returns

[8] F. Kinniry & C. Pettit. (Sep. 29, 2023). Expert Perspective: Staying the course!. https://advisors.vanguard.com/insights/article/investment-advisory-research-center-q3-2023-commentary-staying-the-course

The comments contained herein are a general discussion of certain issues intended as general information only and should not be relied upon as tax or legal advice. Please obtain independent professional advice, in the context of your particular circumstances. This article was written, designed and produced by Financial Literacy Counsel, a registered trade name with Investia Financial Services Inc., and does not necessarily reflect the opinion of Investia Financial Services Inc. The information contained in this article comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any securities.

Mutual Funds and ETFs are offered through Investia Financial Services Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.