Photo by anthony maw on Unsplash

Join us as we explore the economic forecast and investment landscape, similar to checking the weather before stepping out. This quarter we navigate through the economic trends on inflation and interest rates, insights shaping financial climates, and the continued case for diversification.

Macro Update: Checking the Weather App

Much like forecasting the weather, forecasting the economy is an imperfect art. If they are at least directionally correct, we can rely on them for guidance on how to plan for the future.

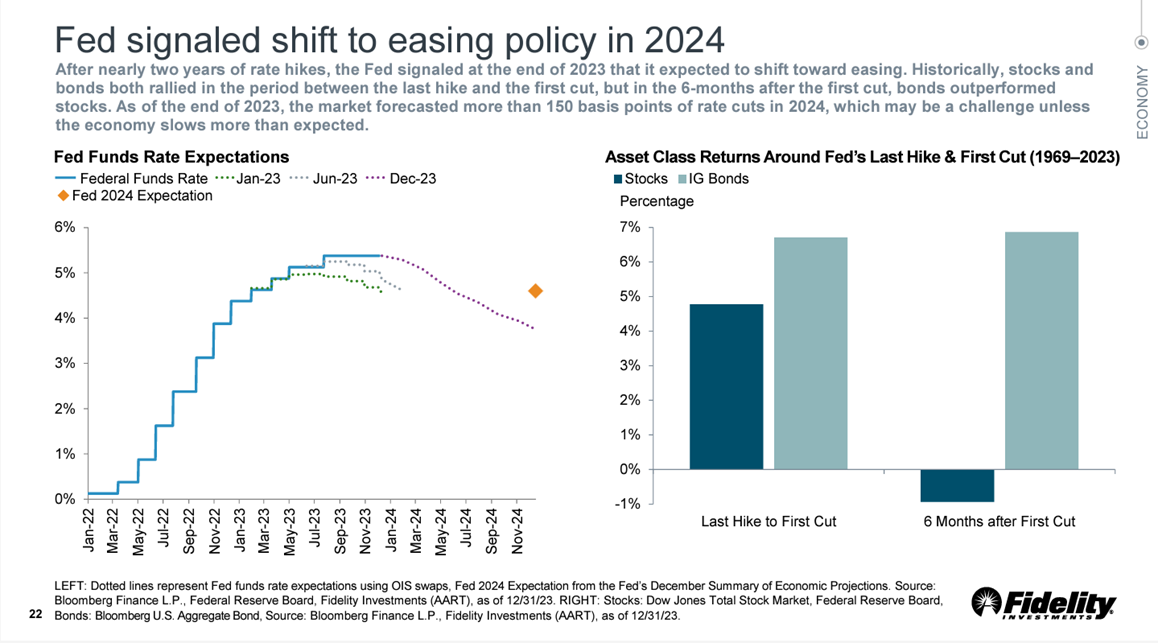

The Bank of Canada (BoC) maintained a 5% policy rate on January 24, 2024, aligning with their previous announcements in the latter half of 2023. They highlighted that wage growth and shelter costs continue to contribute to elevated rates. As the economic climate aligns with projections, the expectation is that inflation will remain at approximately 3% for the coming months, gradually tapering to around 2.5% by the end of the year. Given these positive developments, the BoC has shifted its discussions from assessing whether the policy is “restrictive enough” to deliberating “how long it needs to stay”¹. This signal reinforces the consensus that interest rates have likely reached their peak, contingent on the economy’s anticipated path. It follows a similar U.S. signal sent at the end of 2023².

Russell Investments underscores a Bank of America survey revealing that 74% of fund managers do not foresee a U.S. recession in 2024, a statistic they approach with caution, deeming it overly optimistic³. Conversely, Canadians are more keenly feeling the impact of prevailing interest rate levels. Both Russell and Vanguard investments anticipate a mild recession still in the Canadian forecast this year, with predictions of a series of rate cuts by the end of 2024³,⁴. This projection is welcomed news, creating anticipation of warmer days after a prolonged winter, especially as consumer confidence continues to experience a chilling effect.

Asset Update: (Not so) Surprise Snow

Vancouver experienced one of its most pleasant Decembers in recent years, characterized by minimal rain and abundant sunshine that created a deceptively comfortable atmosphere. However, January brought a change with a light dusting of snow, catching many residents off guard during their commutes.

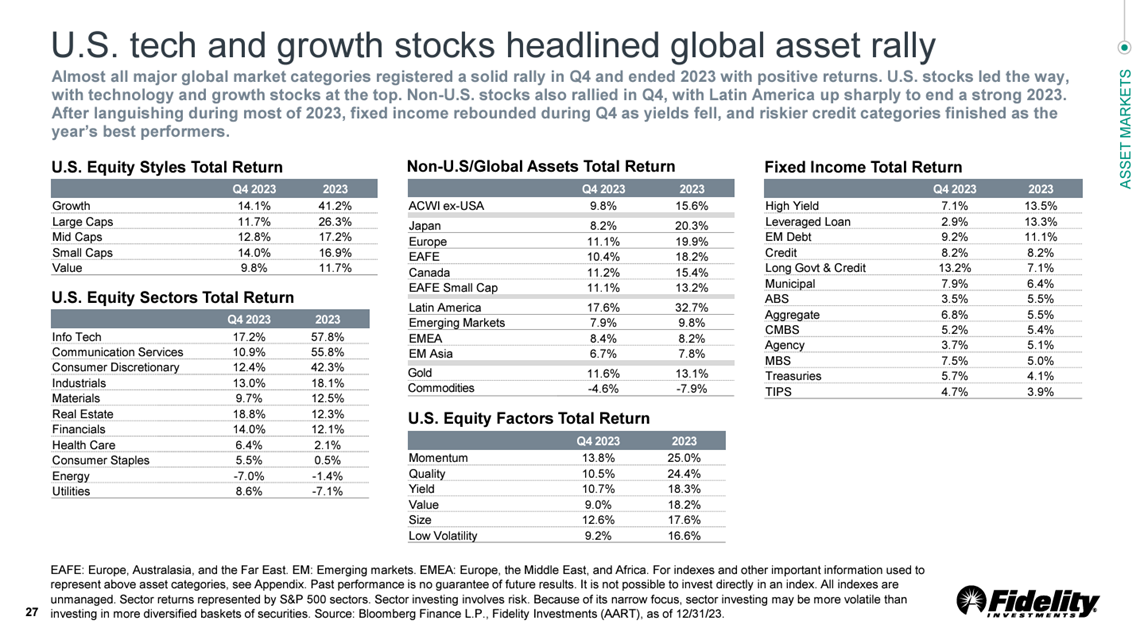

In the financial landscape, 2023 concluded positively for both stocks and fixed income, largely boosted by a robust performance in the final quarter². While the U.S. stock performance may tempt investors to concentrate on high-performing sectors such as growth and tech stocks, the team at Russell advises caution, highlighting that downside risk may outweigh the upside potential. Canadian equities boast a forward price-to-equity ratio of 12, appearing more attractive compared to the more expensive U.S. P/E of 18. This perceived value should also be shared with an acknowledgment that Canadian equities tend to be more cyclical and sensitive to economic downturns³.

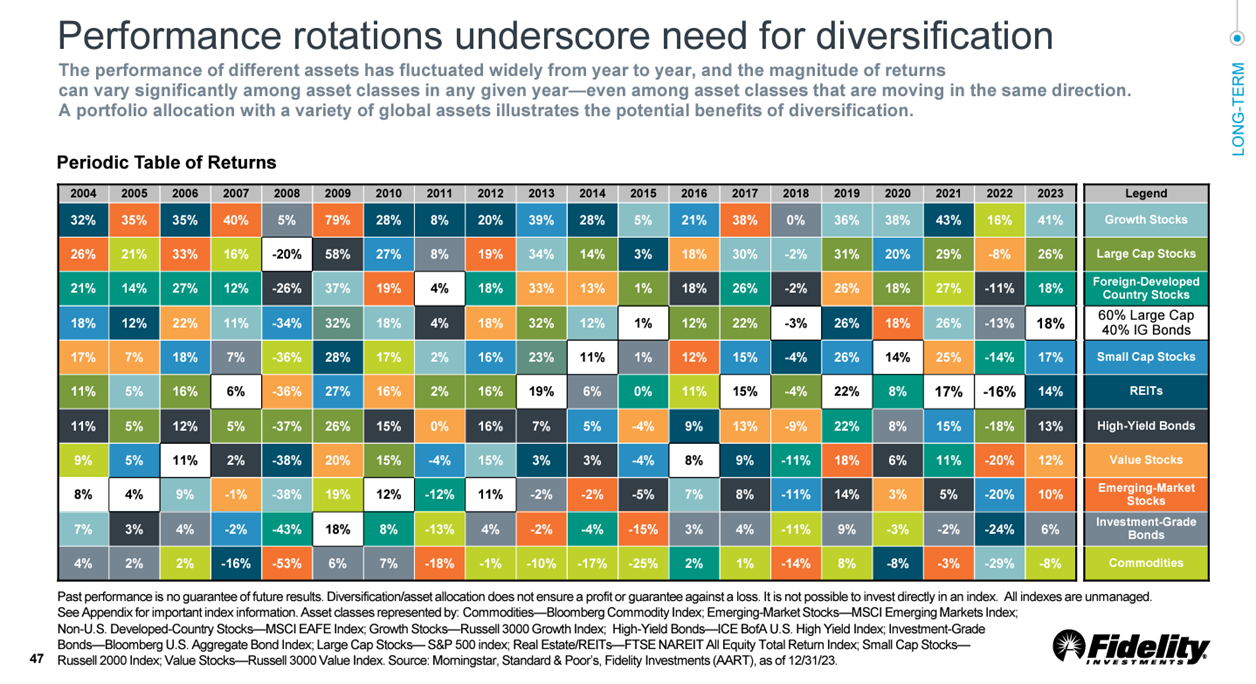

Last quarter, we emphasized Vanguard’s perspective that projected fixed income returns fall within the band for U.S. equities, advocating for a diversified portfolio⁴. Given ongoing economic uncertainty and the understanding that fixed income prices typically ascend when interest rates decline, consider them to be your financial winter tires. In the event of an economic snowfall, they enhance your likelihood of reaching your financial destination unscathed.

Hot Topic: We can never be too careful…or can we?

“Rebalancing is a strategy of realigning your portfolio to your objectives and needs, which should be done at least once a year.”

– Bobby Ning, CFP and Co-Founder of FLC

In 2023, discomfort was prevalent, leading many investors to seek refuge in Guaranteed Investment Certificates (GICs) and High-Interest Savings Accounts (HISAs), offering a secure 5% return. While this approach proved effective for those with a shorter investment horizon, long-term investors may have foregone potential double-digit returns by avoiding a measured level of risk. As a gentle reminder, it’s prudent to schedule an annual review with your advisor. Rebalancing, the strategic realignment of your portfolio to align with your financial objectives, is a crucial exercise in restoring diversification. Additionally, your advisor may present alternative diversification opportunities for your excess cash that better align with your unique financial landscape, mirroring the adaptability required when navigating changing climates.

tions regarding your investments aligning with your long-term plan, it’s advisable to consult your financial advisor.

Summary

Much like checking a weather app, forecasting the economy offers imperfect yet directional insights. The Bank of Canada’s stable policy rate signals a projected economic trajectory, akin to anticipating shifting seasons. Contrasting sentiments between Canadian caution and U.S. optimism echo weather forecasts in different regions, emphasizing the need for diversified portfolios as protective measures. We strongly encourage you to reach out to your advisor if you have any questions about your current portfolio. Strategic realignments, like rebalancing portfolios, underscore the value of annual reviews, ensuring readiness for whatever financial weather lies ahead.

Sources:

[1]Macklem, Tiff. (Jan. 24, 2024). Monetary Policy Report Press Conference Opening Statement. https://www.bankofcanada.ca/2024/01/opening-statement-2024-01-24/

[2] Fidelity Investments. (Jan. 2024). Quarterly Market Update: First Quarter 2024. https://institutional.fidelity.com/app/proxy/content?literatureURL=/956327.PDF

[3] Russell Investments. (Jan. 2024). 2024 Annual Global Market Outlook: THE TWILIGHT ZONE. https://russellinvestments.com/-/media/files/ca/en/insights/global-market-outlook/2024-q1-gmo-summary_ca.pdf

[4] Vanguard Investment Strategy Group. (Jan. 19, 2024). Monthly outlook: Our investment and economic outlook, January 2024. https://corporate.vanguard.com/content/corporatesite/us/en/corp/articles/investment-economic-outlook-jan-2024.html

The comments contained herein are a general discussion of certain issues intended as general information only and should not be relied upon as tax or legal advice. Please obtain independent professional advice, in the context of your particular circumstances. This article was written, designed and produced by Financial Literacy Counsel, a registered trade name with Investia Financial Services Inc., and does not necessarily reflect the opinion of Investia Financial Services Inc. The information contained in this article comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any securities.

Mutual Funds and ETFs are offered through Investia Financial Services Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.