Photo by Mike Benna on Unsplash

Get insights on economic trends and investment strategies with our latest update. Learn about the Bank of Canada’s inflation outlook, current market dynamics, and key highlights from the 2024 Federal Budget, including changes to the capital gains tax and the Home Buyers Plan.

Macro Update: Steady as she goes

¹

On April 10th, the Bank of Canada (BoC) opted to maintain its policy rate at 5%. They anticipate Consumer Price Index (CPI) inflation to hover around 3% in the first half of 2024 before moderating to below 2.5% in the latter half, ultimately reaching the 2% inflation target by 2025².

Russell Investments updated its Canadian recession estimation to occur within the next 12 to 18 months, pushing it into 2025. Immigration continues to bolster the overall economy, yet the current job creation rate doesn’t align with the influx of immigrants. Despite no official recession, GDP per capita has declined by 3.2% since the second quarter of 2022, which they suggest is a “standard-of-living recession”³. Higher debt levels and joblessness pose ongoing risks as indicators of soft demand persist in Canada, with slow sales growth particularly evident in sectors tied to discretionary consumption and residential real estate⁴.

In contrast, Vanguard’s view on the US economy appears more optimistic, with expected real economic growth of about 2.0% in 2024, surpassing their initial estimates of 0.5%. Shelter prices, a significant component of the core inflation, have increased by 5.7% year-over-year, contributing substantially to overall inflation⁵, similar to the current state in Canada.

Asset Update: Keeping the ship stocked

¹

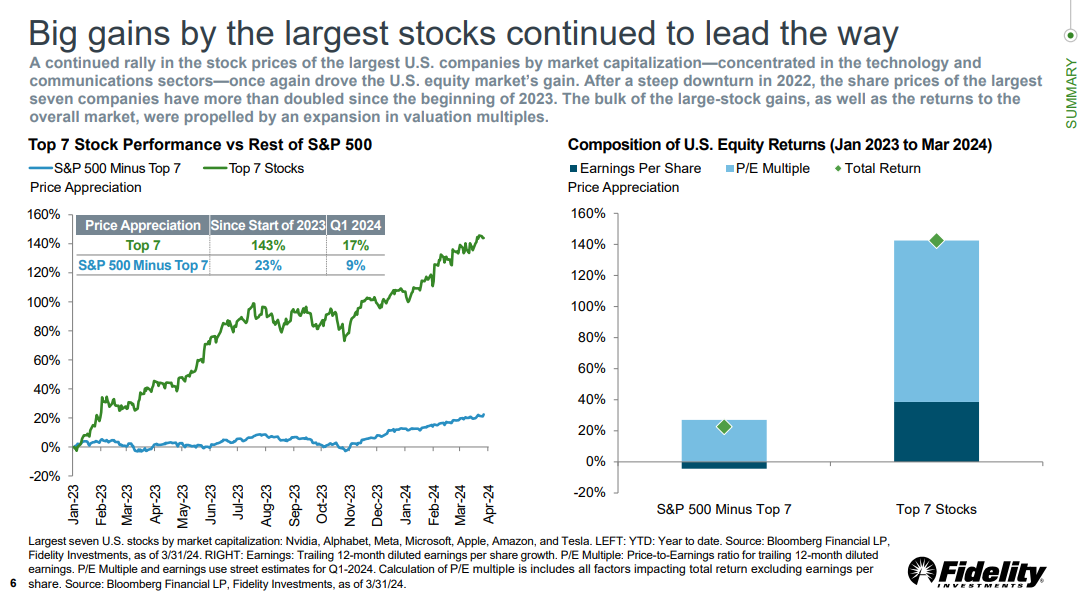

The S&P 500 ended a strong first quarter above 10%, but has pulled back since then, with year-to-date returns at 6.33% as of April 24, 2024⁶. Fidelity’s analysis highlights a continued significant performance gap within the index: by the close of the quarter, the “Magnificent Seven” stocks appreciated by 17%, nearly doubling the broader S&P 500’s growth rate, which stood at 9%¹.

Shifting focus to portfolio strategies, Russell Investments has been prioritizing security selection and diversification to safeguard client outcomes amidst diverse scenarios anticipated in the coming year. While formerly favoring quality equities—companies with strong balance sheets and profitability—this preference was adjusted in February following a period of robust performance for these stocks³. Similarly, Vanguard suggests that though these equities are currently favorable, investors might contemplate maintaining some exposure to large-cap growth stocks. Many have thought these to be overbought, however, they may still have a runway for continued returns⁵. This underscores the value of a diversified portfolio for long-term growth.

Hot Topic: 2024 Federal Budget – is that an iceberg?

Photo by Tom Carnegie on Unsplash

Earlier this month, Canada’s Department of Finance presented the 2024 Federal Budget. By the next morning, many woke up to headlines surrounding the capital gains tax increase from 50% to 67%. The Department of Finance emphasized that this would primarily affect Canada’s highest income earners, as, for individuals, it only applies to amounts in excess of $250,000⁷. However, professionals who are incorporated or planning to incorporate will have to do a deeper dive into potential implications. There will also be greater considerations for estate planning and real estate investment properties.

Prior to the full budget release, the Finance Minister announced an update to the Home Buyers Plan. Canadians can now withdraw up to $60,000, a substantial increase from the previous limit of $35,000, from their tax-sheltered RRSP to facilitate first-time home purchases. This adjustment is expected to provide valuable assistance to those striving for homeownership. You can find additional details about this development on Investment Executive here⁸.

Summary

Photo by Javier Allegue Barros on Unsplash

As we navigate these economic shifts and policy changes together, it’s essential to conduct regular reviews of your financial plan. Remember to keep the principle of diversification top of mind in your investment strategy. Diversified portfolios not only help manage risks but also maximize growth opportunities over time, regardless of market fluctuations. If you’re uncertain about how the Federal Budget developments may affect your financial journey, we encourage you to reach out and connect with your advisor. Your financial well-being is our priority, and we’re here to provide personalized guidance and support tailored to your individual goals and concerns.

Sources:

[1] Fidelity Investments. (Apr. 2024). Quarterly Market Update: Second Quarter 2024. https://institutional.fidelity.com/app/literature/white-paper/9883196/second-quarter-2024-quarterly-market-update.html

[2] Bank of Canada Media Relations. (Apr. 10, 2024). Bank of Canada maintains policy rate, continues quantitative tightening. https://www.bankofcanada.ca/2024/04/fad-press-release-2024-04-10/

[3] Russell Investments. (Apr. 2024). Q2 2024 Global Market Outlook: PENT-UP EXUBERANCE. https://russellinvestments.com/-/media/files/ca/en/insights/global-market-outlook/2024-q2-gmo-full-report.pdf

[4] Bank of Canada. (Apr. 1, 2024). Business Outlook Survey—First Quarter of 2024. https://www.bankofcanada.ca/2024/04/business-outlook-survey-first-quarter-of-2024/

[5] Dziuba, R & Sheridan, M. (Mar. 22, 2024). Portfolio perspectives. https://advisors.vanguard.com/insights/article/series/market-perspectives

[6] S&P Dow Jones Indices. (Accessed on Apr. 24, 2024). S&P 500®. https://www.spglobal.com/spdji/en/commentary/article/us-equities-market-attributes

[7] Government of Canada. (Accessed on Apr. 25, 2024). Budget 2024: Chapter 8: Tax Fairness for Every Generation. https://www.budget.canada.ca/2024/report-rapport/chap8-en.html

[8] Mezzeta, R. (Apr. 11, 2024). Feds boost home buyers plan withdrawal limit to $60,000. https://www.budget.canada.ca/2024/report-rapport/chap8-en.html

The comments contained herein are a general discussion of certain issues intended as general information only and should not be relied upon as tax or legal advice. Please obtain independent professional advice, in the context of your particular circumstances. This article was written, designed and produced by Financial Literacy Counsel, a registered trade name with Investia Financial Services Inc., and does not necessarily reflect the opinion of Investia Financial Services Inc. The information contained in this article comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any securities.

Mutual Funds and ETFs are offered through Investia Financial Services Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.