Photo by Andrea Cau on Unsplash

Stay informed with our latest update on economic trends and investment strategies. Discover the impact of the Bank of Canada’s rate cuts, get the latest economic updates from Canada and the U.S., and review recent asset performance.

Macro Update

¹

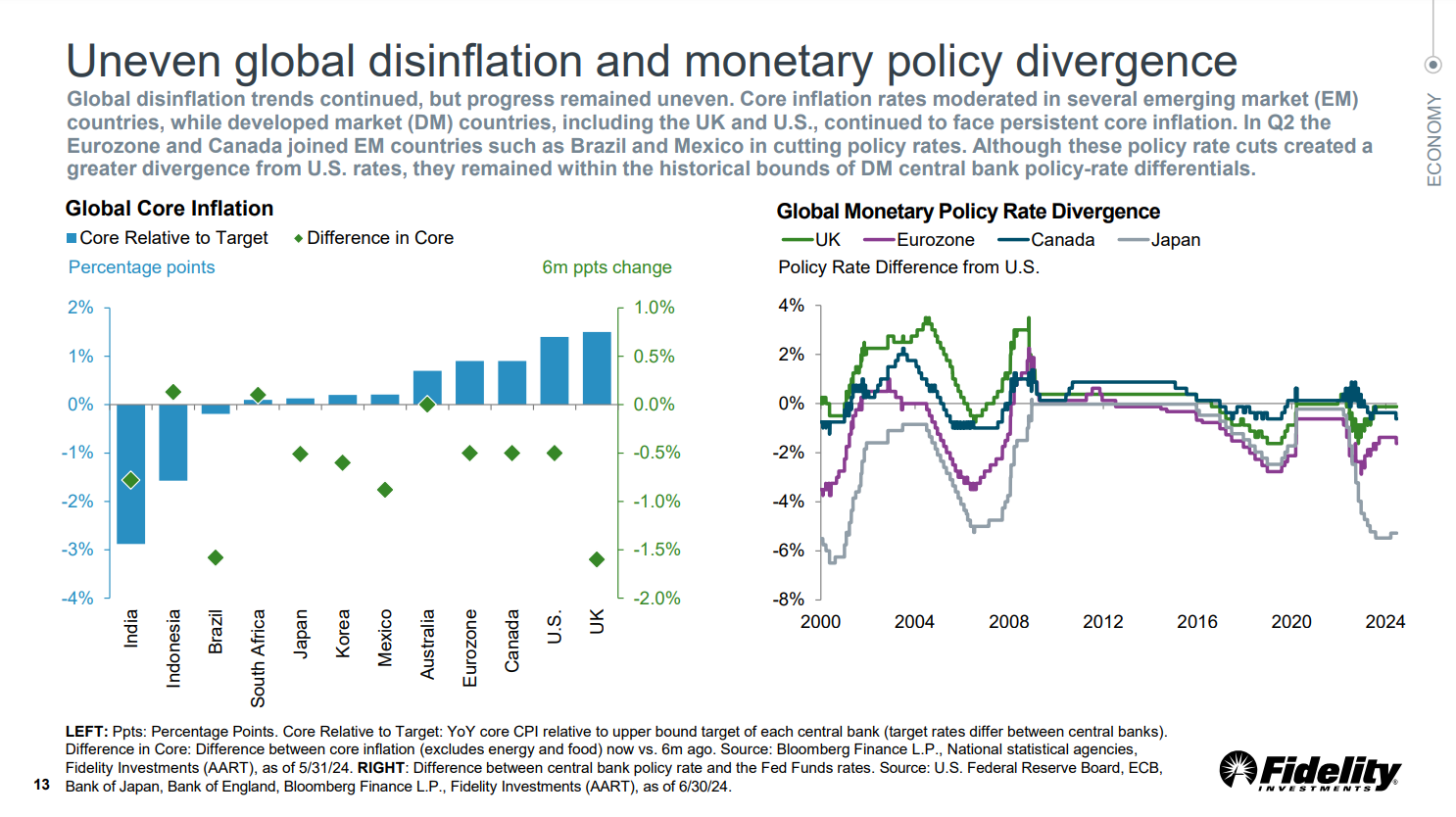

This past quarter, the Bank of Canada implemented two rate cuts, bringing its policy rate down to 4.5%. With a June inflation rate of 2.7%, they maintain expectations that Canada’s core inflation will decline to about 2.5% by the end of the year and reach its 2% target in 2025. The Bank’s decision to reduce the policy interest rate is due to easing broad inflationary pressures and excess supply, while acknowledging that high price pressures in shelter and services are keeping inflation elevated. Future monetary policy will be guided by ongoing assessments of these opposing inflationary forces, with a commitment to achieving price stability².

Russell Investments reiterated that a contraction of over 3% in per-capita GDP over the past two years indicates weaker economic health than headline GDP figures suggest. Additionally, The unemployment rate has risen from 5.4% to 6.2% over the past year. This increase reflects difficulties in absorbing the current influx of immigrants into the labour market³.

In the U.S., Vanguard reports that economic growth indicators, such as productivity gains and retail sales, are showing signs of slowing, leading them to anticipate 2024 GDP growth of around 2.0%. Despite recent favorable inflation readings, which have spurred market expectations of a Fed rate cut in September, Vanguard predicts that the Fed may only implement a modest rate cut in 2024 due to persistent high shelter inflation and a need to balance economic risks⁴.

¹

Asset Update

¹

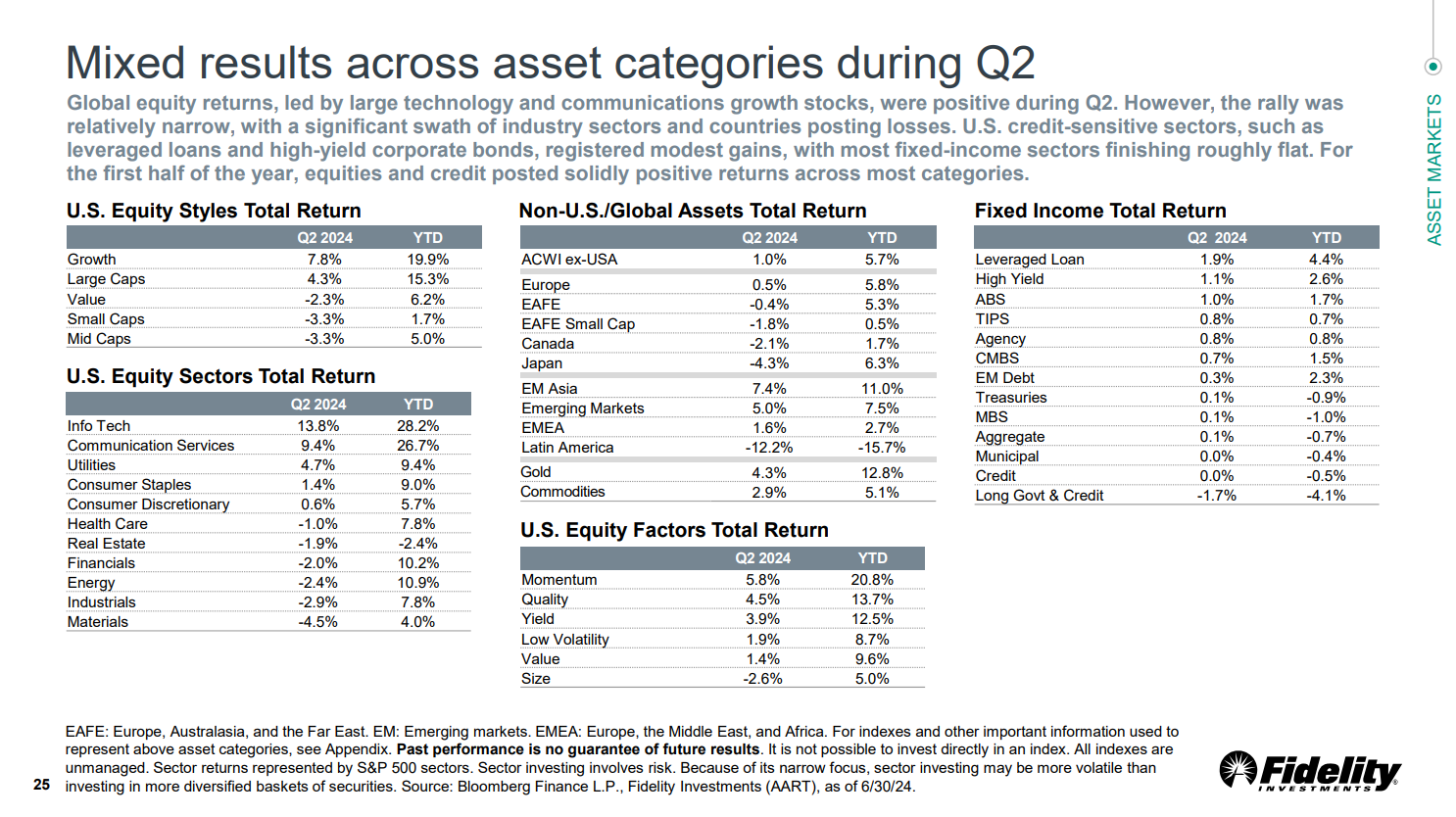

Last quarter we saw the S&P 500 start off with a slight dip, but managed to rally and end June with year-to-date returns at 14.48%⁵. Fidelity’s analysis echos its first quarter findings, showing that “Magnificent Seven” accounted for a 17% return, while the remaining 493 stocks were flat¹.

Vanguard’s updated 10 year projections show U.S. large-cap equities ranging from 3.2-5.2%, while small-cap and value have higher projections from 4.4%-6.8%, but carry more risk⁴. Though valuations may be attractive, Russell adds extra caution as they still believe there is a 35% recession risk in the U.S., which would have a stronger negative impact on small-cap companies³.

Similarly, Russell warns that current valuations of Canadian shares are reasonable, but economic concerns warrant a cautious stance. Despite improved earnings-per-share (EPS) growth estimates, potential downturns could harm corporate profitability. They believe that given the economic uncertainty and continued potential BoC rate cuts, government bonds are expected to perform well. They are seen as a safe investment, especially if a recession occurs³.

Summary

Photo by Javier Allegue Barros on Unsplash

The past quarter has been marked by significant economic adjustments, notably the Bank of Canada’s rate cuts. On the asset front, despite positive performance in major indices like the S&P 500, analysts recommend cautious optimism given the potential for economic downturns. As we have seen each quarter, the market is full of surprises and timing is challenging to predict. In this context, diversification is key to managing risk and seizing opportunities, helping investors navigate market volatility and adapt to changing economic conditions.

If you have any questions about how your portfolio is positioned or if you have had any major life changes, we encourage you to contact your advisor!

Sources:

[1] Fidelity Investments. (Jul. 2024). Quarterly Market Update: Third Quarter 2024. https://institutional.fidelity.com/app/literature/item/956327.html

[2] Bank of Canada Media Relations. (Jul. 24, 2024). Bank of Canada reduces policy rate by 25 basis points to 4½%. https://www.bankofcanada.ca/2024/07/fad-press-release-2024-07-24/

[3] Russell Investments. (Jul. 2024). Q3 2024 Global Market Outlook: THREE-SCENARIO PROBLEM. https://russellinvestments.com/-/media/files/ca/en/insights/global-market-outlook/2024-q3-gmo-full-report.pdf

[4] Vanguard Investment Strategy Group, global economics and markets team. (Jul. 24, 2024). Market perspectives. https://advisors.vanguard.com/insights/article/series/market-perspectives#projected-returns

[5] S&P Dow Jones Indices. (Accessed on Jul. 26, 2024). S&P 500®. https://www.spglobal.com/spdji/en/commentary/article/us-equities-market-attributes

The comments contained herein are a general discussion of certain issues intended as general information only and should not be relied upon as tax or legal advice. Please obtain independent professional advice, in the context of your particular circumstances. This article was written, designed and produced by Financial Literacy Counsel, a registered trade name with Investia Financial Services Inc., and does not necessarily reflect the opinion of Investia Financial Services Inc. The information contained in this article comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any securities.

Mutual Funds and ETFs are offered through Investia Financial Services Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.