Initiating ‘the money talk’ is probably the last thing on your mind as you plan something special for your significant other this Valentine’s Day. However, taking the time to build your financial intimacy may be just the thing you need to bring you even closer together.

Financial intimacy is the freedom to openly, honestly, and safely express financial beliefs, fears, and expectations without fear of judgement, guilt, or shame.

Whether you’re still wondering who should pay for the date or you look forward to splurging on your partner each year, money is part of the relationship at every stage.

In her book Financial Intimacy, Jacquette Timmons writes:

“Money is akin to having a third party in your relationship that showed up on the first date, never went away, and is constant and absolutely necessary. Money supports your lifestyle. It also amplifies what is working in your relationship as well as what needs to be worked on.”

We recently spoke to a registered counsellor whose practice focuses on internal family systems. In her experience, couples often overlook the importance of money in their relationship even though it’s a leading source of tension and a main cause of divorce.

When financial intimacy is neglected, it causes cracks in relationships. Money problems aren’t necessarily any one partner’s fault and can arise simply from managing a limited resource between two people[1]. However, keeping financial secrets is a recipe for disaster.

Being able to talk about and trust one another with money is an integral part of building a strong foundation in your relationship. Although, figuring out how to discuss money with your partner can be a daunting task. Money is still a taboo subject for most. You might know every detail of your friends’ romantic lives, but get dirty looks when you ask about their salary.

If that’s not enough, how we grew up and other past experiences affect our habits and emotions surrounding money. You may have a grandparent or great-grandparent who grew up during the great depression and noticed their extreme frugality, even if they made a good living later in life. Hence, conversations about money are never just about money; financial discourse is fraught with emotions whether it’s shame, fear, anxiety, or envy. This is why financial intimacy will bring you closer together – you’ll be navigating various emotions, not just budgets and bank accounts. To begin disassociating from some of these emotions, start looking at money as a necessary tool rather than a necessary evil.

So how can you build more financial intimacy with your significant other? How can you get on the same page and see eye-to-eye so you can work towards your financial goals and the life you want together?

Here are three steps you can start today to improve financial intimacy with your partner:

Step 1: Open up the lines of communication

Relieve some of the pressure to have ‘the money talk’ by starting small. Start by casually asking your partner questions like, “How comfortable do you feel talking about money?“[2]

As you progress to discussing your financial goals, whether they include saving to buy a house, increasing your salary by 10%, or paying off your student loans, talk to your partner about the ‘Why?’. Ask one another, “Why is this financial goal important to you?”. You may have to ask ‘Why?’ a few times until you come to your core values. The purpose of this activity is to find alignment between each of your life’s visions.

As you open communication, it is important to actively listen to each other’s approach to managing money without judgement. Build your partner’s trust by setting an example with open and honest communication. If your views do not align, don’t pressure your partner to believe what you do. Instead, talk it out and discover what’s behind your decisions to spend or save the way that you do.

Step 2: Connect for a ‘Money Quickie’

Make a habit of doing a financial check-in to strengthen accountability and trust. Depending on the stage of your relationship, the topics may range from discussing financial obligations, fears, goals, and credit scores, all the way to contemplating joint expenses or tax, insurance and retirement planning.

Long-term couples should check-in on their spending plan once a month or—at the very minimum—twice a year to ensure you’re on the same page and your finances are on track.

Here are a few useful rules of engagement:

- Use an app to track your income and expenses. Set aside a specific time that works for the both of you to review your spending together. There are a number of expense tracking apps available and it’s likely one is even offered by your bank.

- Talk about your evolving needs and wants, and how to prioritize unexpected expenses that will inevitably come up.

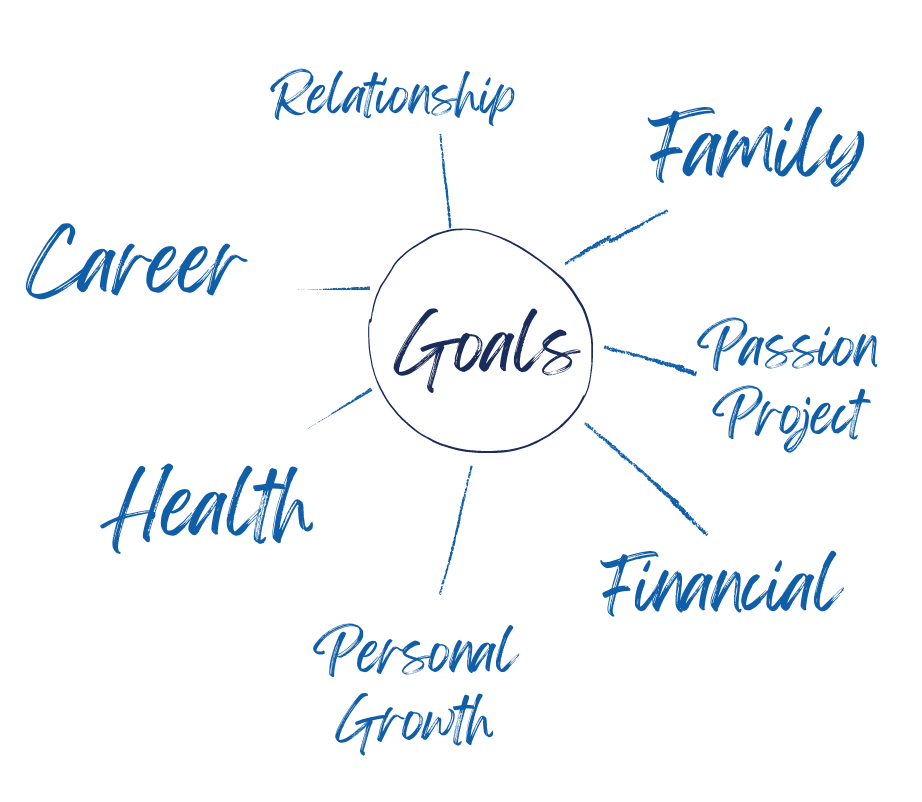

- Regularly update your life goals together. There is something very powerful about seeing your goals on a piece of paper; create individual mind maps by mapping your goals within each major area of your life. The areas will vary per person but could include career, finances, health, passion projects, personal growth, relationships, family, or public service.

Step 3: Seek out professional coaching

Strengthening financial intimacy and building a solid financial house as a couple requires ongoing collaboration.

“Plans fail for lack of counsel, but with many advisors they succeed” is a timeless proverb which applies to couples who understand their limits when it comes to financial, tax and estate planning. It can be difficult to know who to trust to help you with long-term financial planning. Take the time to research options together.

Work with a financial planner who takes an integrated approach and acts a quarterback to your banker, accountant, and/or lawyer, so that all of your professionals are working off the same financial game plan. A recent study from the Financial Planning Standards Council[3] found that Canadians who work with a Certified Financial Planner reported higher levels of emotional, financial, and overall contentment.

This Valentine’s Day, put financial intimacy on the menu! The vulnerability you show by taking this step will help build overall intimacy in your relationship.

At Financial Literacy Counsel (FLC) we understand the importance of building a strong financial foundation in order to reach your life goals. We know that people’s relationships with money are complex and that the value of money is more than just dollars and cents. FLC fosters personal relationships with our clients to build trust and foster collaboration while working towards financial well-being.

If you have questions or would like to book a private financial coaching session with one of our Certified Financial Planners, contact us to book a consultation.

[1] Frugal Confessions. Marriage and Money.

[2] Migaki, L & Schneider, C.M. (August 17, 2021). NPR. If you want to get closer to your partner, start talking about money.