Congratulations on becoming an Optometrist! Now that you have increased your earning power, you may be asking: “What should my financial first steps be?”

Moving your focus towards building a strong financial foundation will not only help you today but will also pay off big dividends in the future.

The majority of new to practice ODs are in their late 20’s or early 30’s and can often feel like they’re playing catch up, since they’re starting to earn money later than their peers. They may have also taken on debt through government student loans or lines of credit from financial institutions with a looming balance of up to six figures, leaving them with little leftover to put towards saving for retirement or a work-optional lifestyle.

Without a doubt, this trifecta can cause financial stress and make new to practice ODs susceptible to making sub-optimal choices with their money.

For over 20 years, Financial Literacy Counsel (FLC) has coached new to practice doctors, helping them optimize their financial choices and get on the right path by using the following 3-step checklist.

Step 1: Act Like a Doctor, Think Like a Business Owner

Protect your profit centre with disability insurance

One of the biggest mistakes new to practice ODs make is failing to shift their mindset from that of an employee to a business owner early on in their career. Since most ODs are self-employed, there is no safety net in terms of extended health benefits and disability insurance. Take this time to educate yourself about how to protect what you are working so hard to build.

Business owners are keenly aware of what generates their money and take the necessary steps to insure these assets against loss. As an OD, your profit centre is your ability to make clinical decisions; without this, you cannot earn an income.

Your first financial priority as a new to practice OD is to seek out a disability insurance plan that is customized to fit your needs today, but will also grow with you as your expenses increase throughout your career. Reach out to BCDO and FLC to learn more about your disability insurance options and exclusive discounts available to ODs in BC.

Step 2: Create and Stick to a Spending Plan

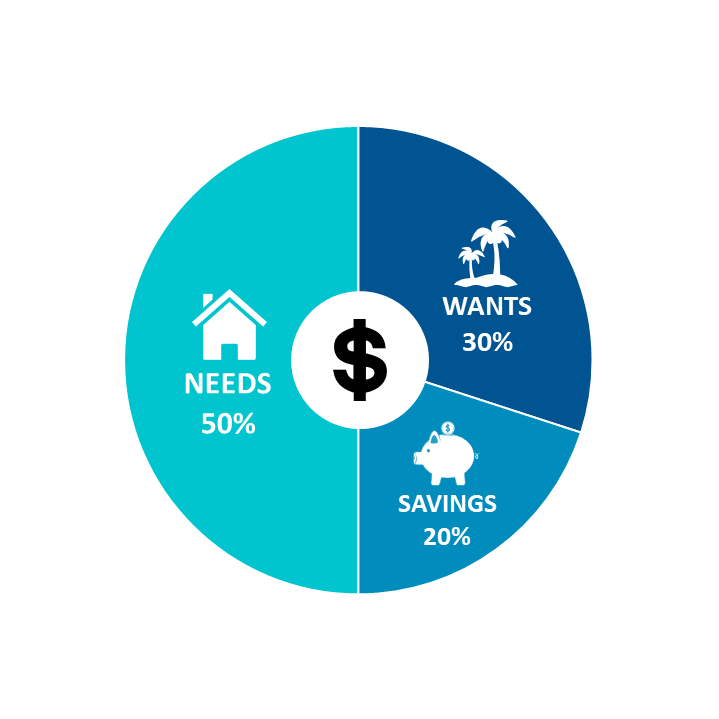

We recommend the 50/30/20 rule

As a self-employed professional you’ll need a game plan to manage your income and expenses. Arming yourself with the knowledge of where your money is going each month puts you in control of your money, rather than your money controlling you.

The next step toward building a strong financial house is to stick to a spending plan that clearly distinguishes your needs, wants and financial goals.

Start by dividing your income into:

50% for Needs:

Expenses you cannot live without such as rent/mortgage, food, basic transportation, minimum debt repayment, and putting away money for taxes.

30% for Wants:

Experiences and luxuries that are nice to have such as eating out, travel, brand name clothing, technology, etc.

20% for Financial Goals:

Long-term goals such as repaying debt, buying a home, achieving a work-optional lifestyle, saving for retirement etc.

Step 3: Speak to a Financial Planner Who Understands Your Journey

Contact BCDO to access your financial coaching benefits

“Plans fail for lack of counsel, but with many advisors, they succeed,” is a timeless proverb that applies to doctors who are focused on their practice and understand their limits when it comes to financial, tax, and legal planning.

Now is a good time to start interviewing financial professionals who understand your unique journey as an optometrist or get a second opinion on your current financial plan.

As part of your BCDO member benefits, you have support when it comes to managing your finances and building a solid financial house. BCDO partners with FLC to provide you with 2 financial coaching sessions to address your top financial concerns. Within these sessions, you’ll receive a financial ‘prescription’ with recommendations that will detail which next steps to consider as you embark on your career.

This article was written for BC Doctors of Optometry Eye Digest magazine.