In honour of medical students graduating and entering residency this week, we asked a few of our clients what they wish they knew before entering or during residency. The responses generously came from clients who had completed their residency in recent years or are near the end of their program.

When it comes to balancing work and life during residency…

“I wish I had tapped into the power of building periods of work and rest into my schedule. I learned to avoid procrastination during residency, but it was a slow process. I could have had much more time for myself had I been more effective in completing my non-clinical work tasks and set aside dedicated time to finish them, with a set deadline. Just finish it, whatever it is! There will then be time for other things instead of a protracted period of half-effective work and poor-quality downtime.” – Anesthesiology Physician, completed residency in 2017

“Taking more time away from work fully (i.e., no phone, computers, etc.) actually resulted in higher quality learning and efficiency when I was working. I would ensure I had 30-60 minutes before bed, a minimum of 4 days a week (due to call schedules) for uninterrupted downtime.” – Family Physician and Addiction Medicine Consultant, completed residency in 2021

“I had some phases where I wanted to keep work and life completely separate and others where I had coworkers on a certain rotation of similar age and interests when I wanted to keep them aligned. You don’t have to create a hard separation; it’s okay to be flexible and try to expand your personal network within a professional setting too, as sometimes only co-residents understand your exact circumstances.” – Family Medicine Resident Doctor, completing residency in 2024

When it comes to communicating with their partner…

“Advocate for time with the partner outside of medicine with no medicine talk to ensure there was space for intimacy and intentional time and conversations. Ensuring that concerns and feelings are always communicated during this very difficult time and finding a way to balance the feelings of guilt due to the lack of time and ensuring free time is used effectively.” – Family Physician and Addiction Medicine Consultant, completed residency in 2021

“Constant communication is difficult, but the small, frequent check-ins are better than days without contact.” – Family Medicine Resident Doctor, completing residency in 2024

When it comes to debt…

“I was quite conservative in my spending but still worried about my debt. I wish I had worried less. I was doing everything I could to avoid excessive debt and quickly settled it once I started working. There wasn’t much more I could have done and the worrying was not productive. I did practice saving, setting aside a tiny amount into RRSPs every month. I think this helped to promote good habits and did contribute to managing my anxiety about my debt.” – Anesthesiology Physician, completed residency in 2017

“Do rural rotations! There are incredible student loan forgiveness programs when applied at the right time and can significantly reduce federal and provincial loans while also getting great learning and exposure. Do your best to reduce unnecessary expenses but also don’t be afraid to do little things for yourself +/- spouse or family. Everyone is different with the stress tolerance for debt and what they deem as necessary.” – Family Physician and Addiction Medicine Consultant, completed residency in 2021

“As a renter, living with a roommate is the most financially significant decision I made in terms of maximizing savings and debt reduction. The rent will inevitably take >50% of your salary in Metro Vancouver, and there’s only so much cost-cutting you can do with food and entertainment in an effort to combat a large monthly rental bill before it becomes futile.” – Family Medicine Resident Doctor, completing residency in 2024

To be continued…

In Part 2 of this article, we will share what residents wish they knew about self-care, income and benefits, mistakes, and wins.

Finally, to reiterate what was shared during Resident Orientation Day, it is crucial to prioritize your well-being, be kind to yourself, and nurture all aspects of your health, which also includes your financial wellness. Remember to seek help if anything feels off to address any issues while they are still small. Your RDBC membership comes with a myriad of wellness benefits, including 2 complimentary financial coaching sessions to help improve your financial wellness so that you may focus on caring for others. We also host the annual RDBC tax clinic to help you file your taxes and receive your tax refund sooner.

The transition from medical school to residency is truly a remarkable achievement. While adjusting may initially feel overwhelming, we encourage you to embrace them as opportunities for growth and self-discovery. We hope the guidance and wisdom from those who have walked this path before you have provided some clarity and ease as you embark on the next phase of your journey.

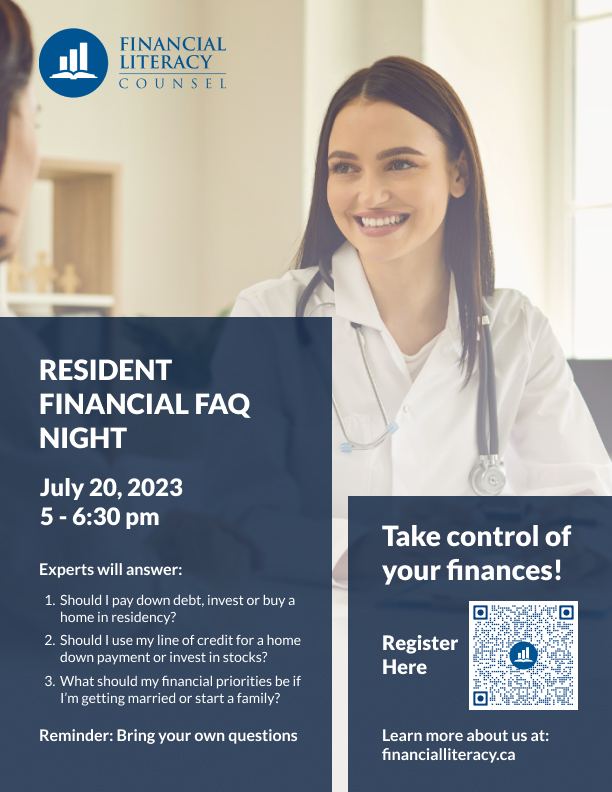

REMINDER: Resident Financial FAQ Night

We wish you all the best and hope to see you join us for a virtual Resident Financial FAQ Night on July 20th from 5pm-6:30pm. This event is designed to answer some questions surrounding real estate and provide you with some insights on your own questions as well! To register please click on the following link, https://us02web.zoom.us/meeting/register/tZ0vc-yqrDgoEtK_HsVbuAzC850RYy2pQsPA, or scan our QR code in the image below.

The comments contained herein are a general discussion of certain issues intended as general information only and should not be relied upon as tax or legal advice. Please obtain independent professional advice, in the context of your particular circumstances. This article was written, designed and produced by Financial Literacy Counsel, a registered trade name with Investia Financial Services Inc., and does not necessarily reflect the opinion of Investia Financial Services Inc. The information contained in this article comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any securities.

Mutual Funds are offered through Investia Financial Services Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.