Financial market volatility has increased in recent months prompting many discussions with clients about where we are in the economic cycle and what all this means for their portfolios.

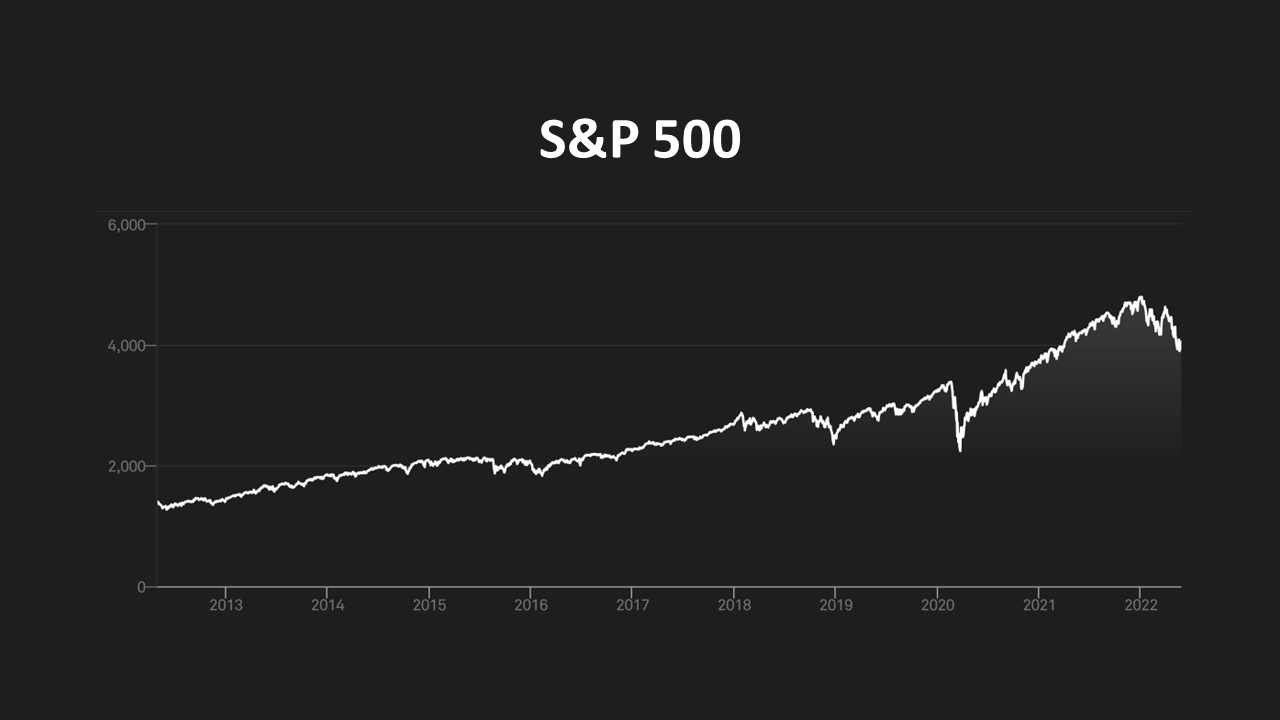

The uncertainty created by the outbreak of the COVID-19 pandemic impacted global stock markets causing the S&P 500, NASDAQ, and Dow Jones Industrial Average to all enter bear market territory in March 2020. What surprised many was the fact that they recovered relatively quickly and 2 years later they have—boosted by vaccine optimism and financial stimulus—largely recovered from their pandemic lows.

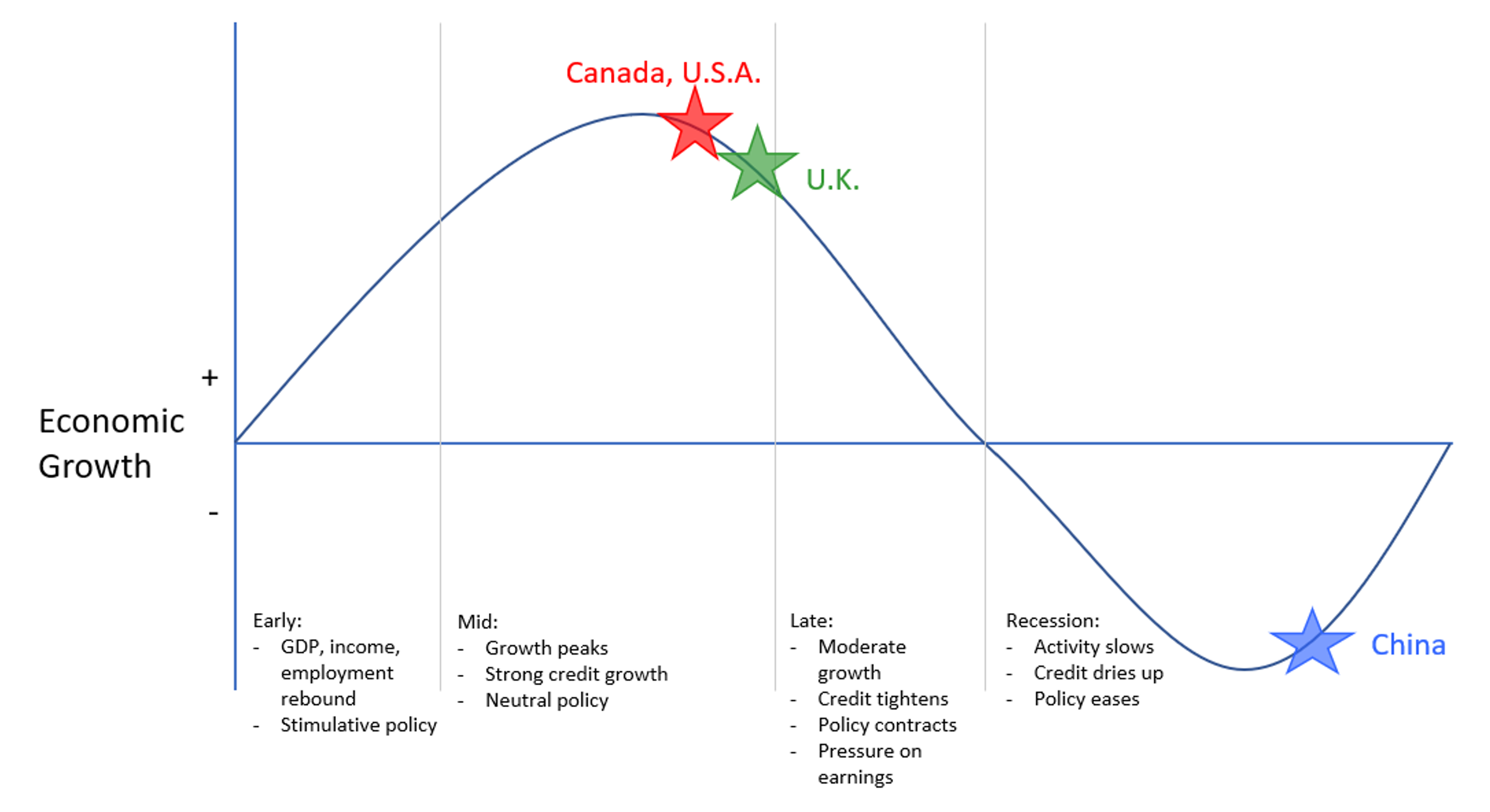

Whilst at Financial Literacy Counsel (FLC) we believe that the Canadian, US and EU economies are all in the mid-cycle expansion phase, we should be mindful that economic recovery is likely to take longer than market recovery, particularly as we all experience the effects of rising inflation and supply chain issues.

Volatility is normal

We often hear clients ask, “What do I do when the market drops?”. A key part of FLC’s investment philosophy is taking a long-term approach with investment portfolios.

One of our clients, Olympian Melissa Lotholz, recently commented in an interview that her advisor (Patrick Chee) has taken the time to get to know her as “a person, an athlete, her finances and her comfort levels” enabling him to make personal recommendations to suit her future goals. All our advisors create strategies that are designed to help you achieve your long-term aspirations and ride out any short-term volatility.

If you have a long-time horizon, then you will have a greater proportion of your assets invested in equities. Volatility in equity markets is normal as they are inherently risky assets driven by company performance, consumer sentiment and macroeconomics.

If we look at the performance of the S&P 500 over the last 10 years you can see that there have been sudden drops in performance, particularly in December 2018 (fueled by fears of a trade war between the US and China) and in March 2020 (due to the first COVID-19 lockdown). Nevertheless, if you had stuck through the drops and remained invested in the market you would have made great gains.

Stimulus Measures

As pandemic restrictions are removed, travel restrictions are abolished, and workplaces re-open governments are starting to back on their stimulus packages. This poses several problems which may create choppy markets in the short term.

At the outbreak of the pandemic in March 2020, the Bank of Canada responded immediately by lowering and starting a program of quantitative easing—essentially pumping “new money” into the economy. The goal was to boost economic activity aided by a range of relief benefits the government introduced to support individuals and businesses.

In October 2021, however, the Bank of Canada announced that it would be unwinding many of its emergency stimulus measures, including the quantitative easing program, in response to the global economy recovery. They are not alone in doing this and investors around the world have been shocked by the speed at which central banks are easing off these measures.

At FLC we are keeping a close eye on announcements from the USA Federal Reserve. There is a risk that if they remove their stimulus measures too quickly the growth currently in progress will slow and the economy could be at risk of falling into recession.

It is important that we support you by taking a disciplined approach to managing your investments and keeping you on track to achieve your financial goals. By regularly reviewing your portfolio and understanding your unique situation FLC is better able to support you through these more turbulent times.