Click on each of the benefits listed below to learn more:

Custom-fitted benefits to protect you

The Professional Series® disability insurance offered by RBC Insurance® is great a option for those looking to protect their income in the case of injury or disability. BCDO members have access to this disability insurance at discounted rates ranging from 15-25%.

Whether you are a new grad or well into your practice, you may rely on your income for various monthly expenses. These may include your student loans, rent or a mortgage, and general living expenses for you and your family. If you are unable to work due to an injury or illness, you are still obligated to make your monthly payments. By enrolling in a disability plan, you can ensure that you and your family are able to focus on your health, instead of your finances.

If you would like to get started or have some questions, click on the button below:

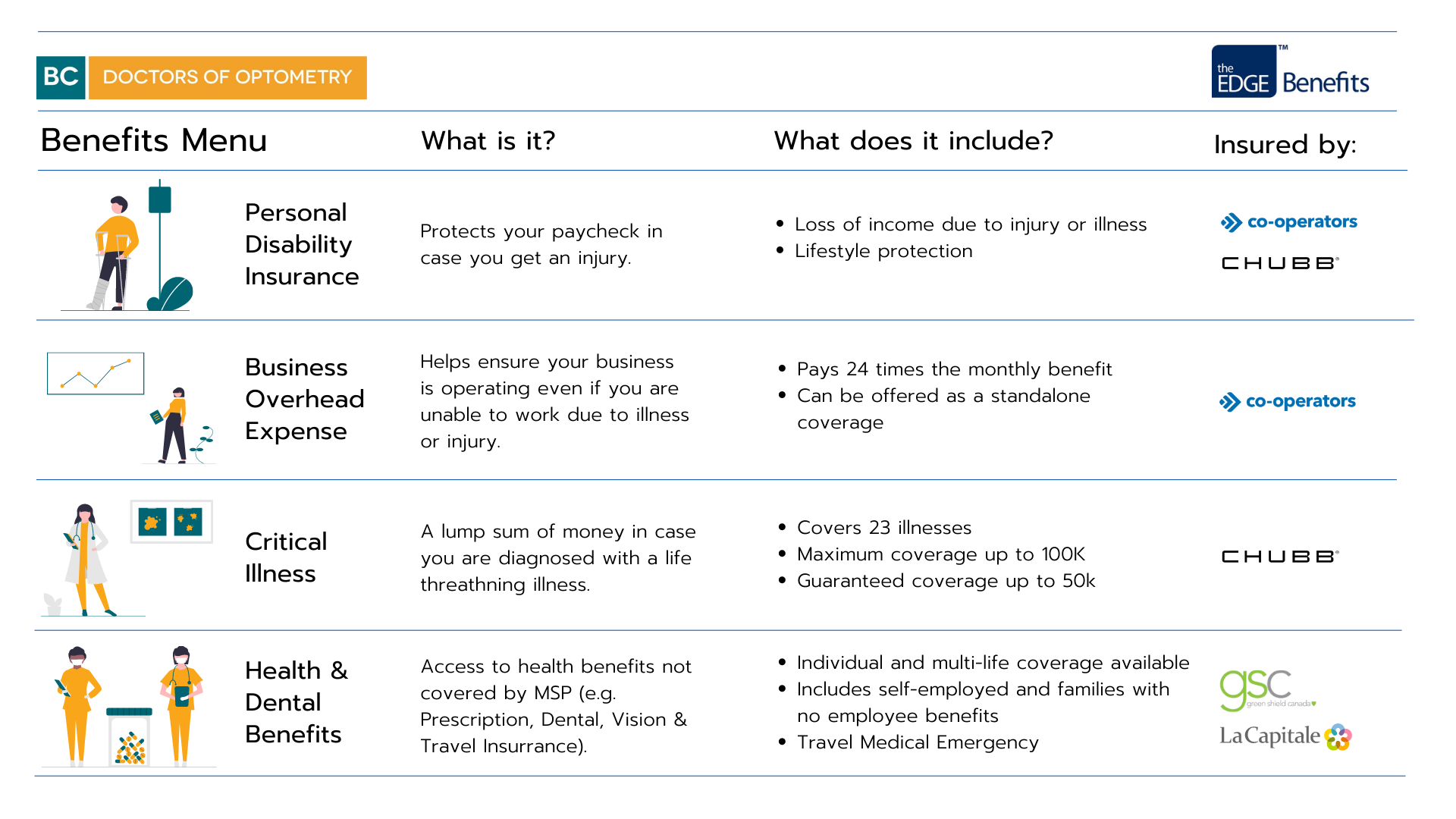

EDGE and BCDO have partnered to offer members and their staff bespoke health insurance solutions with both simplified medicals and management.

For those concerned about their insurability, this is a non-medical coverage option for injury-only. While WCB will insure you for accidents that occur while on the job, the EDGE plan protects you 24/7.

A disability coverage for your business expenses. This option helps ensure that your monthly business expenses, such as your employee salaries and leases on rent or equipment, are taken care of. Keep your clinic running, even when you can’t.

Aside from injury, certain health situations may require you to spend time healing or in treatment. During this time, your partner or a family member may need to take time off from work to help care for you. In the case of a confirmed diagnosis, such as a heart attack, stroke, or cancer, you will receive a lump-sum payout to ease the financial burdens during this time.

This option is a flexible health and dental plan with predictable costing for yourself and your employees. While other providers may require underwriting, the basic EDGE plan is a guaranteed issue policy for ages 18-69 with coverage up to the age of 75. With this plan, you always know what to expect.

A completely customizable health benefit solution that allows you to pay only for what you need. With a health spending account, you choose the amount allotted to each plan member.

Plan members are then able to make claims directly through the app, and reimbursements are deposited to their bank accounts. As the employer, you only pay for the claims made, up to the amount that you had set.

It is available to a range of group sizes, including incorporated individuals and small or medium clinics.

Benefit to you and your staff: The account provides additional health and wellness support. It can be used on its own or to top-up an existing extended healthcare plan.

Benefit to incorporated individuals: Turn your personal health expenses into a business expense. This will help reduce your taxes as the expenses can be paid for with corporate dollars that are taxed at a lower rate than personal income.

If you would like to get started or have some questions, click on the button below:

*Financial coaching services provided by Financial Literacy Counsel

© 1999 - 2024 Financial Literacy Counsel Inc. All Rights Reserved.